Whether an ERISA plan, an endowment or foundation, a private trust, or an individual investor, all of the parties involved in the investment process must work in coordination with each other and have a clear understanding of where their individual roles and responsibilities begin and end. Documentation ensures continuity of the investment strategy when there is a change to any of the parties, prevents misunderstandings between them, and avoids omission of critical fiduciary functions.

Clearly defining the scope of the Investment Advisor’s engagement is particularly important at a large firm, where the Advisor may also work in a non-fiduciary capacity providing other client services. Most investors assume that their financial advisor always acts solely in their interests. However, while many advisors may act in an ethical manner, they may not always be legally required to act as a fiduciary and to serve their client’s best interest.

The scope of an Investment Advisor’s engagement often includes the responsibility to choose an appropriate combination of asset classes to optimize the client’s portfolio. This involves structuring the portfolio to achieve maximum portfolio returns consistent with the client’s investment objectives, risk tolerance and time horizon. The Investment Advisor’s choice of asset classes and subsequent allocation typically will have more impact on the long term performance of the client’s investment strategy than the selection of money managers.

The number of asset classes should be consistent with the Investment Advisor’s (in some cases, the client’s) implementation and monitoring constraints. No formula can determine the best number of asset classes – the appropriate number is determined by facts and circumstances. The Investment Advisor should keep in mind that the allocation also must be implemented and monitored. It makes no sense to make an allocation to an asset class that cannot be effectively and efficiently implemented and/or monitored on an ongoing basis.

The Investment Advisor and client should discuss both the theoretical and practical dimensions of risk. Ultimately, the advisor and client must achieve a mutual understanding of the client’s investment objectives and establish the client’s tolerance for risk consistent with the investment time horizon. The best practice is to stress test an investment strategy by analyzing the worst case, most likely and best case outcomes over one, three and five year periods.

The expected return is the probable return of an investment strategy given current and historical information. There is no fiduciary requirement, or expectation, that the Investment Advisor be capable of forecasting future returns. Rather, they are required to demonstrate the prudent process that was followed in developing the assumptions used to model the probable outcomes of a range of investment strategies.

The preparation and maintenance of each client’s IPS is one of the most critical functions performed by the Investment Advisor. The IPS should be viewed as the business plan for managing an investment portfolio.

The IPS should be consistent with the terms of the governing documents, such as the plan document or trust. If applicable, it should also be aligned with, and make reference to, legislation governing investment activities of the plan or portfolio; e.g., ERISA, IAA, UPIA, UPMIFA, and UMPERSA.

The IPS should be a formal, long-range strategic plan that allows the Investment Advisor to coordinate the management of each client’s investment program in a logical and consistent framework. All material facts, assumptions, and opinions should be included.

The Investment Advisor is required to manage investment decisions with a reasonable level of documentation. By memorializing the details to writing in a mutually agreed-upon IPS, the Investment Advisor can (1) avoid unnecessary differences of opinion and the resulting conflicts with clients, (2) minimize the possibility of missteps due to lack of clear guidelines, (3) establish a reasoned basis for measuring success, both in terms of meeting the client’s objectives and the Investment Advisor’s efforts, and (4) establish and communicate reasonable and clear expectations with clients.

The benefits of a well-written IPS are:

For private clients, the IPS helps to provide implementation guidance during estate planning, particularly when one spouse is still actively managing all or a significant portion of the investable assets. Often, it’s the “investing spouse” who is the first to become incapacitated, leaving the surviving spouse and/or executor with the near impossible task of maintaining the former investment strategy. An IPS thoughtfully prepared in advance and integrated within the overall estate plan helps to ensure smooth transition of the investment management decisions, particularly if there is a change in investment advisors.

Investment Advisors will be held to an “expert standard of care” and their activities and conduct will be measured accordingly. If the Advisor is involved with ERISA plans as the 3(38) investment manager, the role of selecting other service providers will likely be more complex and involved than when working with individual clients. Nevertheless, the primary role of the Investment Advisor is almost always to guide the client’s investment process. The Advisor may act with discretion, as in the case of the 3(38) role, or may make recommendations for an institutional fiduciary or individual investor client to act upon. In either situation, the Advisor is expected to apply sound due diligence to select or recommend investment strategies; individual stocks, bonds, or other securities; and outside money managers or other service providers, like custodians.

It is important for the Investment Advisor to be familiar with the universe of investment options (i.e., mutual funds, exchange-traded products, separately managed accounts and alternative investments), prudently select them, and document the process, for no one implementation structure is right for all occasions.

For Qualified Retirement Plans, the CEFEX Advisor is assessed on adherence to Safe Harbors. Safe harbors are highly desired by fiduciaries because they mitigate fiduciary risk. They provide prescriptive formulas for taking certain actions in ways that are deemed to be consistent with fiduciary obligations. Thus, while there may be alternative approaches that would not constitute breaches of fiduciary duties, the safe harbors provide clear and certain methods of avoiding liability.

The Investment Advisor has a duty to control and account for all dollars spent for investment management services, whether the dollars are paid directly from the account or in the form of soft dollars and other fee-sharing arrangements. In addition, the Advisor has the responsibility to identify those parties that have been compensated from the fees, and apply a reasonableness test to the amount of compensation received by any party.

If the Advisor uses funds or managers with higher than average fees, then the rationale for paying up must be documented.

The fundamental duty of the Investment Advisor is to act solely in the best interest of another party, such as a financial planning client, retirement plan participant, or trust beneficiary. In addition, the Advisor has a responsibility to employ an objective due diligence process at all times. If a client is harmed by a decision not conducted at arm’s length, then a breach of the fiduciary duty of loyalty is likely to have occurred. A good working definition of a conflict of interest is a circumstance that makes fulfillment of the duty of loyalty less reliable.

Whenever possible, the best solution is to avoid situations or relationships that give rise to conflicts. However, financial services regulations frequently allow an advisor who acts in a fiduciary capacity to also hold licenses to sell related products or services in a non-fiduciary capacity. Therefore, managing conflicts in a client relationship can be a complex ethical and legal challenge.

If conflicts of interest exist, the Investment Advisor must disclose them in the Service Agreement. Service agreements should directly disclose the information needed by fiduciaries or individual clients to perform appropriate due diligence or should include references to specific disclosure documents that provide the information.

For most investment fiduciaries, monitoring can be labor-intensive, because it may involve a need to respond to changes in the economic or market cycle, the pricing of investment services, retirement plan arrangements, and the circumstances directly impacting the client’s financial situation or outlook. No one should be lulled into thinking that the ‘heavy lifting’ was done in the previous three steps and the client portfolio is now on ‘auto pilot,’ marked only by periodic re-balancing, quarterly performance reports, and routine client meetings.

The Investment Advisor’s monitoring function extends beyond a strict examination of performance. By definition, monitoring occurs across all policy and procedural issues previously addressed on this page. The ongoing review, analysis, and monitoring of relevant decision-makers and/or money managers are just as important as the due diligence implemented during the service provider selection process. In keeping with the duty of care, an Investment Advisor must determine the frequency of reviews, taking into account such factors as: (1) prevailing general economic conditions, (2) the size of a client’s portfolio, (3) the investment strategies employed, (4) the investment objectives sought, (5) the volatility of the investments selected, and (6) the fiduciary or other regulatory obligations to the client. The Investment Advisor should monitor every investment option implemented at least quarterly, or more frequently as required by the facts and circumstances.

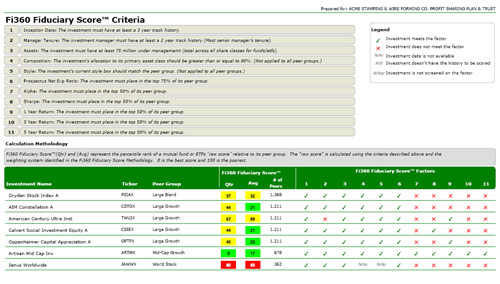

In addition to the quantitative reviews of Investment Managers, periodic reviews of the qualitative performance and/or organizational changes to the Managers should be made at reasonable intervals. On a periodic basis (e.g., quarterly) the Advisor should review whether each Investment Manager continues to meet specified objectives.

This is where the fiduciary duty of care takes on special meaning with respect to assessing the advisor’s overall effectiveness in meeting his or her fiduciary obligations. Planned fiduciary assessments conducted at regular intervals provide for this needed review.

The CEFEX certified Advisor effectively addresses this precept by undertaking independent annual assessments based on a standard of fiduciary best practices.